How to Improve Visibility and Data Insights in Project Risk Management

Why improved Visibility and Data Insights Are Crucial for Project Success

In today’s fast-paced corporate environment, achieving full visibility into risk data is essential for effective risk management, as traditional methods often lack the accuracy needed for informed decision-making. By utilizing digital risk management solutions, organizations can enhance visibility and leverage critical data, ultimately leading to improved project outcomes.

Despite recognizing its importance, many companies struggle to attain genuine visibility in projects leading to lost time and effort with little transparency achieved.

Let’s examine the significance and uncover the practical strategies and approaches that can improve the project’s visibility beyond the routine of weekly updates.

Maximizing Efficiency: The Importance of Project Visibility

Project visibility refers to the extent to which stakeholders, team members, and decision-makers have access to relevant, up-to-date information regarding a project’s status, progress, risks, and resource allocation. This transparency fosters clear communication throughout the project delivery process, ensuring all essential stakeholders understand performance metrics, responsibilities, and overall objectives. It also enables project managers to identify bottlenecks and potential risks that may hinder project efficiency.

Navigating Uncertainty: The Imperative of Proactive Risk Management

Organizations today are forced to deal with multiple internal and external challenges. Stricter regulations, compliance requirements, and close competition have only put more pressure on the organizations, leaving them with very little space for profit. This brings to the fore a high level of uncertainty, adding to the organization’s risk exposure. That’s why Organizations need to reconsider their approaches and perspectives to manage unavoidable risks in a controlled and effective manner and make faster and better business decisions. To achieve effective risk management, organizations must focus on being proactive with the ability to look at what the risks of the near future are rather than being merely reactive. This proactive approach to risk management can help drive competitive advantage as well as ensure sustainability and growth.

A proactive risk management method differs from a reactive one in how risks are assessed, reported, and mitigated. It involves thoroughly evaluating processes to identify potential risks, identifying risk drivers to understand the root cause, assessing probability and impact to prioritize risks, and developing a contingency plan appropriately. To do so, risk managers must learn to assess the strength of the organization’s innovation component and apply that knowledge effectively to address existing and emerging risks. Also, using the experience of experienced risk managers to engage in strategic risk management can be highly beneficial.

This forward-thinking approach enables businesses to achieve organizational sustainability and competitive advantages, a better understanding of corporate goals and objectives, personnel management, and considerable reductions in risk and costs. When done correctly, it enables them to:

- Prioritize and manage risks and opportunities throughout an organization in a way that increases company value.

- Convert risk into a strategic advantage.

- Gain necessary visibility into the priorities for improving business performance.

To illustrate the importance of improved risk visibility and data analysis in project management, consider these two real-world examples that highlight how organizations have successfully improved their risk management processes:

Construction Industry – TRUE Projects (Australia):

TRUE Projects, a construction company in Australia, leveraged project management technology to enhance risk visibility and transparency across its projects. By using a cloud-based, real-time system, the company achieved 30%-time savings in data management and 15% in data entry. This allowed better coordination between departments, enabling more informed decision-making, minimizing delays, and reducing human error. This improved risk management significantly enhanced project timelines and cost efficiency.

Link: Smartsheet

Oil & Gas Industry – Chevron:

Chevron implemented advanced data analytics tools for risk management in their oil and gas operations. These tools provided better insights into equipment performance, maintenance needs, and operational hazards. By leveraging predictive analytics, Chevron reduced unplanned equipment failures, thus minimizing downtime and improving operational safety. This approach significantly reduced risks associated with project delays and unexpected costs, contributing to improved project outcomes in highly complex environments.

Link: ConstructionLink

These examples underline the critical role of project visibility in risk management, enabling organizations to foster a culture of transparency and make informed decisions, ultimately leading to better project outcomes.

Best Practices for Effective Risk Management and Data Collection

In modern project management, the use of advanced software solutions for risk data collection has become imperative. Risk management software and project management platforms streamline the identification, assessment, and mitigation of risks. These tools improve decision-making by offering real-time data, automation, and insightful analyses. They ensure that project teams can respond quickly to emerging risks, thus reducing the likelihood of project delays or budget overruns.

Let’s take a look at the 5 best Practices for Effectively managing the risks:

Involve stakeholders

Involve stakeholders in risk management at all stages, starting with the first evaluation. Managers, clients, employees, shareholders, unions, and other individuals can all be considered stakeholders.

Many of these people may be critical staff and integral to your risk management operations. Each symbolizes different roles and responsibilities inside the company, while providing a comprehensive view of all business components and associated risks.

Establish a strong risk culture

Developing a strong risk culture is our second risk management best practice, and it is an important component of any effective risk management program. Risk culture is characterized as a group’s shared values, beliefs, and attitudes about risk.

Who bears the risk?

Management and the board of directors are primarily responsible for clearly communicating the company’s culture, training personnel on necessary security measures, and setting the tone for compliance from the start. Management buy-in is necessary to ensure that the relevance of risk identification and awareness spreads throughout the entire organization.

Communicate

Effective risk assessment and management begin with communication. Effective risk communication is vital for raising awareness within your organization.

Communicating across your business about major risks (or risks with a high organizational impact) enables all departments to adequately discover, assess, mitigate, and monitor emerging risks.

Clear risk management policies

Developing these explicit rules will assist you in identifying all potential risks to your business, their likelihood and impact, how you intend to mitigate and prevent existing risks, and how you will monitor for and manage new risks.

To create explicit risk management policies, answer the following questions:

- Is your Risk Assessment Policy well documented?

- Are roles and responsibilities clearly defined?

- Are there clearly defined rules and processes for mitigating any and all identified risks?

- Do you have a business continuity plan (BCP) and an incident response plan (IRP) in place that outline how your organization will deal with and overcome unexpected risks?

- Are these policies effectively communicated to all employees?

Continuous Risk Monitoring

After doing your initial risk assessment and installing the necessary controls to reduce and address these risks, the next critical step is monitoring. Clear monitoring methods must be established to ensure that all risk reduction strategies are operational and effective.

Continuous monitoring enables proactive detection and reaction to possible threats, ensuring that your business is robust in the face of changing dangers. Regular audits and reviews should be performed to ensure that risk management practices are current and consistent with the organization’s goals.

Organizations that maintain a diligent approach to risk monitoring can keep ahead of potential risks and preserve their resources, reputation, and overall business continuity.

Utilizing Data Analytics for Risk Assessment and Cost Control

Data analytics involves analyzing raw data to extract meaningful insights that guide decision-making. In today’s technology-driven world, where data plays an important role the ability to quantify risk and make comparisons is more essential than ever. Companies are increasingly dependent on analytics, especially in the realm of risk management.

By leveraging data analytics, businesses can identify potential risk factors for disruptions and take proactive measures to prevent these issues from affecting their operations. This proactive approach not only helps save resources and establish better cost control by avoiding interruptions but also improves recovery efforts by providing insights into the extent of damage and the associated restoration costs.

Techniques for Analyzing Risk Data in Project Management Software Solutions

In project management, effective risk analysis is fundamental for anticipating and mitigating potential disruptions. Software solutions employ several key techniques to analyze risk data, ensuring that projects remain on track and within budget. The primary techniques include statistical analysis, historical data analysis, and real-time tracking.

- Statistical Analysis: This technique involves using mathematical methods to understand and predict risk patterns. Project management software often integrates statistical models to analyze data distributions, correlations, and trends. Techniques such as regression analysis and Monte Carlo simulations help project managers assess the probability of various risk scenarios and their potential impact on project outcomes. This approach allows for more informed decision-making by quantifying the likelihood and severity of risks.

- Historical Data Analysis: Historical data analysis leverages past project data to identify risk patterns and trends. By examining previous project outcomes, software solutions can highlight recurring issues and predict potential risks for current projects. This technique involves analyzing past project timelines, budget overruns, and resource allocation to uncover insights that guide future risk management strategies. Tools that utilize historical data help in benchmarking and setting realistic expectations based on empirical evidence.

- Real-Time Tracking: Real-time tracking involves monitoring project metrics and risk indicators as they occur. Modern project management software provides real-time dashboards and alerts that track key performance indicators (KPIs) and risk factors. This technique enables project managers to quickly identify deviations from the plan, address issues as they arise, and adjust strategies accordingly. Real-time tracking enhances the ability to respond to emerging risks promptly, ensuring that corrective actions are taken before minor issues escalate.

Interpreting Data Insights for Risk and Opportunity Identification

The process of only gathering the necessary data is not a complete one, that’s why in this segment we must highlight the importance of how to interpret data insights to identify potential risks and opportunities early. There are 5 steps that’s needs to be covered in order to get the desirable outcome of the collected data.

Step 1: Define your risk objectives

Before leveraging data and analytics to identify risk, a company must first define what risk means within its specific context. This involves clarifying the company’s goals, priorities, and expectations. It is imperative to identify potential threats and opportunities that could impact these objectives. Additionally, the company needs to determine how to measure and evaluate its risk exposure and performance. By addressing these questions, the company establishes risk objectives and criteria that will guide subsequent data collection and analysis efforts.

Step 2: Collect relevant data

The next step is to collect relevant data to identify risks in business. Depending on the established risk objectives, a company may need data from various sources, including financial records, customer feedback, market research, industry reports, and regulatory compliance information. This data should come from both internal sources—such as the company’s systems, processes, and employees—and external sources, including competitors, suppliers, and customers. A comprehensive and accurate risk identification process relies on the breadth and depth of the data collected.

Step 3: Analyze the data

Once the data has been collected, it must be analyzed to identify patterns, trends, and anomalies that may indicate potential risks. Various tools and techniques can be employed for this analysis, including descriptive, diagnostic, predictive, and prescriptive analytics.

- Descriptive analysis, which identifies what has already happened

- Diagnostic analysis, which focuses on understanding why something has happened

- Predictive analysis, which identifies future trends based on historical data

- Prescriptive analysis, which allows you to make recommendations for the future

Step 4: Communicate the results

After analyzing the data, it is important to communicate the results to relevant stakeholders within the company, including managers, employees, partners, and investors. The presentation of these results should be clear, concise, and actionable, utilizing formats such as reports, presentations, or alerts.

Key findings, insights, and recommendations must be highlighted to assist in identifying and managing risks effectively. Additionally, it is important to explain any assumptions, limitations, and uncertainties that might impact the results, such as data quality, reliability, or validity. This transparency ensures that stakeholders have a comprehensive understanding of the analysis and can make informed decisions based on the presented information.

Step 5: Implement the actions

The final step involves implementing the actions derived from the data and analytics to identify and manage risk within the business. Actions should be prioritized based on their urgency, impact, and feasibility, with responsibilities and resources assigned accordingly for execution.

It is vital to monitor and evaluate these actions’ outcomes regularly, adjusting as needed based on feedback and new data. This iterative process ensures that data and analytics are used effectively and efficiently to manage risks, continuously improving the business’s risk management strategies.

Improving Communication and Reporting Systems

In project management, best practices for regular updates, risk reporting, and stakeholder involvement are needed to preserve transparency and project success. Digital software solutions play an important role in improving these behaviors and provide various benefits.

Regular Updates: Regular updates are used for keeping all stakeholders informed about project progress and emerging risks. Digital software solutions, such as project management platforms and collaboration tools, facilitate timely and efficient communication. These tools allow for real-time updates, automated notifications, and centralized information sharing, ensuring that everyone involved has access to the most current data.

Risk Reporting: Effective risk reporting involves systematically documenting and communicating potential risks, their impacts, and mitigation strategies. Digital software solutions provide advanced analytics and reporting features that help in tracking risk indicators, generating comprehensive reports, and visualizing risk data through dashboards and charts. This improves the ability to monitor risks continuously and make informed decisions based on up-to-date information.

Stakeholder Engagement: Engaging stakeholders throughout the project lifecycle is vital for addressing concerns, gathering feedback, and aligning expectations. Digital tools facilitate stakeholder engagement by offering platforms for collaboration, discussion forums, and feedback mechanisms. These solutions help ensure that stakeholder input is integrated into project planning and execution, fostering a collaborative environment, and enhancing project outcomes.

Regular Updates: Regular updates are used for keeping all stakeholders informed about project progress and emerging risks. Digital software solutions, such as project management platforms and collaboration tools, facilitate timely and efficient communication. These tools allow for real-time updates, automated notifications, and centralized information sharing, ensuring that everyone involved has access to the most current data.

Collaboration among the team members: A project is only as effective as its team. Effective communication among team members encourages better teamwork, collaboration, idea exchange, and solving problems. To ensure that interactions run well, project managers must develop communication standards, tools, and platforms. They need to understand their team members’ communication expectations in order to communicate effectively with each member of the team.

Integrating Risk Management with Project Planning

Integrating strategic risk management into the project planning process allows companies to effectively navigate uncertainties and make informed decisions to protect their investments and achieve their objectives. Strategic risk management is a proactive approach that identifies, assesses, and mitigates potential risks before they become major obstacles.

Project planning lays the foundation for success and ensuring that goals are met within the defined timeline and budget. Success often comes with uncertainties and potential risks that can impede progress and jeopardize the project. This is where strategic risk management brings great value.

Once risks are identified, the next step is risk assessment, which involves evaluating each risk’s probability and potential impact on the project’s objectives. By assigning a risk rating to each identified risk, project managers can prioritize their efforts and allocate resources effectively. This approach ensures that the most critical risks are addressed first, thereby minimizing their potential impact on the project’s success.

Following risk assessment, the focus shifts to risk mitigation. This phase involves developing strategies and action plans to reduce both the likelihood and severity of recognized risks. Mitigation strategies may include implementing controls, creating contingency plans, establishing communication protocols, providing training, or considering alternative project methodologies. Proactively addressing risks in this manner helps to minimize potential adverse effects on the project.

An equally important component of strategic risk management is regular monitoring and review. Risks are dynamic and may evolve as the project progresses, with new risks potentially emerging. Therefore, continuous monitoring of the project’s environment and regular reassessment of risks are the necessary components of effective project management. Consider a large-scale IT implementation project where the team initially identified potential challenges related to data security and user adoption during risk assessments. As the project progressed, they routinely monitored external factors, such as emerging cybersecurity threats and changes in user behavior.

During one of their assessments, they discovered a new industry vulnerability, prompting them to adjust security protocols before any issues occurred. This proactive approach not only protected sensitive data but also increased stakeholder confidence.

In another scenario, a marketing campaign for a product launch encountered shifting market dynamics due to unexpected competitor actions. The project team regularly reassessed their risk landscape and pivoted their strategy in real time, reallocating resources to focus on innovative promotional tactics that addressed the competitive threat. This adaptability allowed them to maximize their impact and achieve higher engagement levels than initially expected. By continuously adapting their strategies and taking timely actions, project managers kept the project and its milestones on track despite emerging or changing risks.

Strategic risk management is pivotal in project planning. Through proactively identifying, evaluating, and mitigating potential risks, companies can fortify their projects against unpredictability, increasing the chances for success.

The Impact of Risk Management on Project Outcomes

Poor risk management can dramatically derail project outcomes, resulting in delays, budget overruns, and reduced quality. When risks are not properly detected, analyzed, or managed, teams become subject to unforeseen challenges that can interrupt project timelines, raise costs, and even lead to project failure. According to the Project Management Institute (PMI), effective risk management is critical for proactively addressing anticipated challenges and reducing their impact on project objectives. A lack of planning and inadequate response tactics can also undermine stakeholder trust, lower team morale, and lessen the likelihood of future project success. This approach ensures that projects stay on schedule, reacting quickly to challenges while meeting objectives.

Conclusion

Improving visibility and data insights is essential for effective project risk management. In this article, we explored key strategies for improving data collection, using advanced analytics, and fostering better communication among stakeholders to deepen your understanding of how data drives project success.

By applying these approaches, especially through digital software solutions, you can manage risks more effectively, leading to better project outcomes and overall success.

PPM Core Project Portfolio Management software with its valuable features can improve the Visibility and Data insights in Project Risk Management.

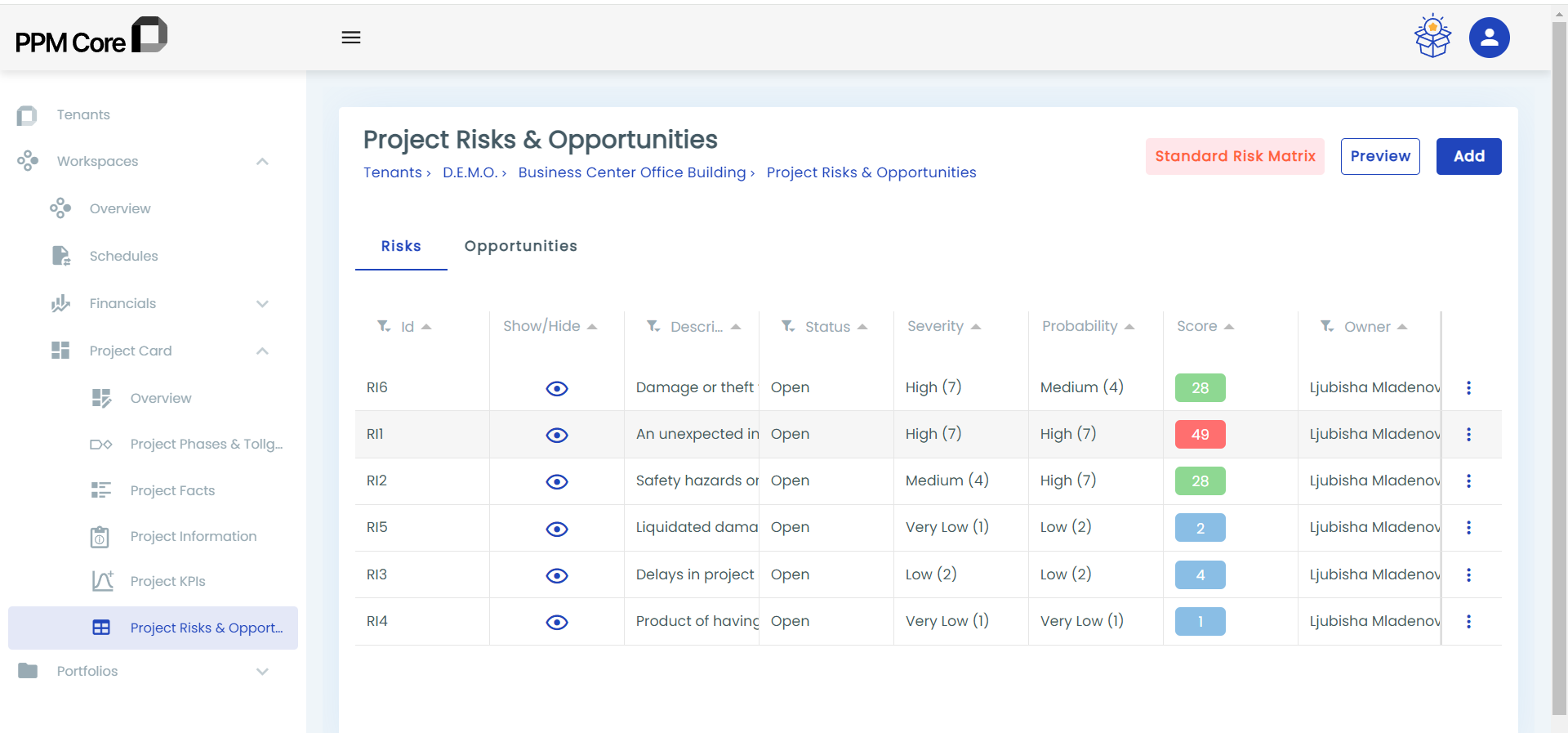

Risks and Opportunities

The Project Card segment of the PPM Core allows users to categorize risks and opportunities, considering all factors affecting the project plan while providing better management of project risks.